What is Fintech?

Fintech, short for financial technology, refers to the application of innovative technologies to enhance and automate financial services. It encompasses a wide range of digital solutions, software, and platforms that aim to revolutionize various aspects of the financial industry, including banking, payments, investments, insurance, lending, and wealth management.

Fintech companies leverage advancements in areas such as mobile applications, data analytics, artificial intelligence, blockchain, and cloud computing to provide faster, more convenient, and user-friendly financial services. These technologies enable individuals, businesses, and financial institutions to access and manage their finances efficiently, make transactions securely, and gain insights into their financial activities.

Fintech has disrupted traditional financial systems by offering digital alternatives to traditional banking and financial services. It has empowered individuals with greater control over their financial activities, introduced more personalized and tailored financial solutions, and improved financial inclusion by reaching underserved populations.

Examples of Fintech companies

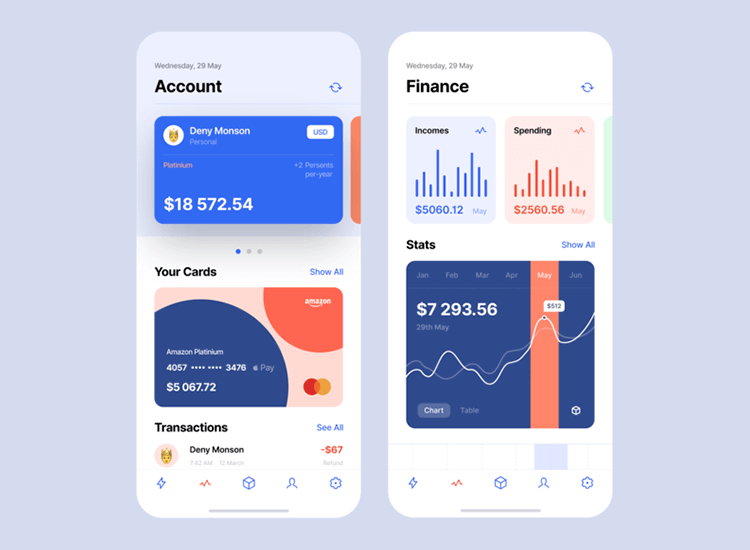

An example of fintech is a mobile banking app that allows users to manage their finances, make payments, transfer funds, and access financial information through their smartphones.

This app combines technology, banking services, and user-friendly interfaces to provide a convenient and accessible financial experience.

Here are a few well-known examples of fintech companies/products:

PayPal: PayPal is a widely recognized fintech company that provides online payment solutions. It allows individuals and businesses to make secure online transactions, transfer money internationally, and manage their finances through its digital platform

Square: Square offers a suite of fintech products, including point-of-sale (POS) systems and payment processing solutions. Their flagship product, Square Reader, enables small businesses to accept credit card payments through mobile devices.

Robinhood: Robinhood is a popular fintech company that offers a commission-free trading platform for stocks, exchange-traded funds (ETFs), and cryptocurrencies. It aims to make investing accessible to a broader audience through its user-friendly mobile app.

Stripe: Stripe is a fintech company that provides online payment processing services for businesses. It offers a seamless integration of payment gateways, allowing businesses to accept online payments securely and efficiently.

Coinbase: Coinbase is a well-known fintech company specializing in cryptocurrency services. It operates as a digital currency exchange, allowing users to buy, sell, and store various cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

5 main types of Fintech products:

Payments and Money Transfers: Solutions that enable secure and convenient payment processing, money transfers, and remittances. Examples: PayPal, Venmo, Wise (formerly known as TransferWise)

Lending and Financing: Platforms that offer online lending, peer-to-peer lending, crowdfunding, and alternative financing options. Examples: LendingClub, VIVA Finance.

Personal Finance and Wealth Management: Applications and platforms that assist individuals in managing their finances, budgeting, investing, and wealth management. Examples: Betterment, Acorns.

Insurance: Insurtech companies that leverage technology to streamline insurance processes, claims management, and policy underwriting. Examples: Lemonade, Root Insurance, Oscar Health.

Blockchain and Cryptocurrencies: Technologies and platforms that facilitate decentralized financial transactions, smart contracts, and digital currencies. Examples: Coinbase, Ripple.

Building a Fintech Product

The process of building a fintech product that will be valuable for the society (and hopefully bring financial success to you and your team) will be years if not decades long. So don't expect this process or guide to be a straight forward set-in-stone step by step journey.

In the fast-evolving landscape of financial technology (fintech), building a successful product requires careful planning, industry expertise, and the ability to navigate regulatory challenges.

Having that in mind, there's a few items we should take in consideration.

Understanding the Fintech/Lending Industry:

Before diving into product development, it is essential to gain a deep understanding of the fintech and lending industry. Research market trends, customer demands, and existing solutions. Identify gaps or pain points that your product can address. Stay updated with regulatory requirements to ensure compliance throughout the development process.

Domain Expertise and Regulatory Knowledge:

Having prior experience in the fintech or lending industry can significantly benefit founders. It provides valuable insights into industry dynamics, customer behaviors, and regulatory frameworks. Knowledge of data security, privacy laws, and financial regulations ensures that your product is built with compliance in mind, minimizing legal risks and enhancing trust among users.

Identifying the Main Barriers and Challenges:

Creating a successful fintech product involves overcoming several challenges. These can include:

Trust and Security: Building trust in the digital realm is crucial. Implement robust security measures, encryption protocols, and data protection mechanisms to safeguard user information.

Regulatory Compliance: Fintech products often operate within a complex web of regulations. Stay abreast of regulatory changes and collaborate with legal experts to ensure compliance throughout the product's lifecycle.

Technology Infrastructure: Develop a scalable and secure technology infrastructure that can handle high volumes of transactions and user data. Leverage cloud services and consider the use of emerging technologies like blockchain and artificial intelligence to enhance efficiency and security.

Customer Acquisition and Retention: Competition in the fintech industry is fierce. Define a comprehensive marketing and customer acquisition strategy to attract and retain users. Focus on providing a seamless user experience and personalized solutions to differentiate your product.

From ideation to execution when creating a successful fintech product.

So, let's start this journey! First let's work on the idea so we can fall in love with it and create your empire from there:

Ideation:

Identify a Market Need: Conduct thorough research to identify specific pain points or gaps in the market where your fintech product or service can provide a solution. Look for areas where technology and innovation can bring significant improvements and address customer needs more effectively.

Conduct Market Research: Dive deeper into your target market to understand the demographics, behaviors, preferences, and challenges of your potential customers. Identify their current pain points and evaluate existing solutions in the market. This research will help you refine your product offering and tailor it to the needs of your target audience.

Refine Your Idea and Value Proposition: Based on market research insights, refine your initial idea and develop a clear and compelling value proposition. Define how your fintech product or service will solve the identified problem better than existing solutions, and highlight its unique benefits to potential customers.

Develop a Business Plan: Create a comprehensive business plan that outlines your market analysis, target audience, revenue model, marketing strategy, operational plan, and financial projections. This plan will serve as a roadmap for your startup and guide your decision-making process. It is also crucial for attracting potential investors and securing funding.

Setting your company up for success

Build a Strong Team: Assemble a team with diverse skills and expertise in finance, technology, marketing, and operations. Seek co-founders or team members who share your vision and bring complementary skills to the table. A strong team is essential for the success of your fintech startup and helps in overcoming challenges with collective knowledge and experience. A mix of on-site employees with a team nearshore software engineers could be the perfect blend you're looking since will provide the benefits of close collaboration, creativity and team bonding while keeping the budget in check. Your investors will thank you for it. If you're pursuing this path, make sure you check a product development partner for your fintech product, be mindful of checking past customer reviews and ensuring they have the knowledge and the engineering firepower to grow with you as your team gets bigger and bigger.

Right Tech Decisions: Important decisions will be made at this stage, tech stack being one of them. You'll want to make sure your tech stack is reliable, maintainable and easy to find engineers that can work on your product. Your CTO will have an strong impact at this stage.

Secure Funding: Determine your startup's financial needs and explore various funding options. These may include self-funding, bootstrapping, angel investors, venture capital, or government grants. Prepare a compelling pitch deck and business plan to attract potential investors and secure the necessary funds to execute your fintech startup idea.

Establish Legal and Regulatory Compliance: Understand the legal and regulatory requirements specific to the fintech industry in your target market. Consult with legal experts to ensure compliance with financial regulations, data privacy laws, and consumer protection measures. Being proactive in addressing legal and compliance matters will build trust and credibility for your startup.

The fun part, The Execution Phase

Build a Minimum Viable Product (MVP) and Minimum Lovable Product (MLP): Develop a Minimum Viable Product (MVP) that includes the core features and functionalities necessary to address the identified market need. The MVP should be a simplified version of your product that allows you to gather user feedback and validate your assumptions. Additionally, consider building a Minimum Lovable Product (MLP), which enhances the MVP with a focus on delivering an exceptional user experience and incorporating elements that users will find delightful. The MLP goes beyond functionality and aims to create an emotional connection with users.

Test and Gather User Feedback: Conduct user testing and gather feedback on your MVP/MLP from your target audience. This feedback is crucial in understanding user preferences, pain points, and areas for improvement. Incorporate the feedback to refine and enhance your product iteratively, ensuring that it aligns with user needs and expectations. Some useful tactics for this moment are:

Adding A/B tests to your fintech product: This allows you to quickly evaluate between two approaches or ways to present your product or functionalities of it, allowing you and your team to understand if users are using the platform as you expect.

Implement Feature Flagging: Make sure you are releasing functionality to your fintech product incrementally, this way you keep users engaged and always waiting for the next release.

Allow users to make suggestions: No fintech product will be perfect for the users right off the bat, you will definitely need input from a set of beta users and allow them to provide suggestions for current and future development of your product.

Growth & Adaptation

Iterate and Scale: Based on feedback and market response, iterate and improve your product iteratively. Continuously refine your product based on user insights, focusing on scalability, performance, security, and user experience. Monitor market trends and adapt your strategy accordingly to ensure your fintech startup stays competitive and meets evolving customer demands.

Establish Partnerships: Identify potential partnerships that can enhance your fintech product's reach or provide necessary resources and expertise. This may include collaborations with financial institutions, banks, technology providers, strategic alliances, or integration with complementary products or services. Partnerships can help accelerate your growth and provide access to a broader customer base.

Launch and Marketing: Plan a comprehensive launch strategy to create awareness and generate interest in your fintech startup. Utilize digital marketing channels, social media platforms, content marketing, and PR campaigns to reach your target audience effectively. Highlight the unique value proposition and benefits of your product to attract early adopters and gain traction in the market. A pretty effective way to create "hype" around your fintech product is to create a waiting list that opens a few month before the official launch to end users.

Monitor Metrics and Analytics: Set up analytics tools to track key performance indicators (KPIs) related to user acquisition, user engagement, conversion rates, revenue, and other relevant metrics. Analyze the data to gain insights into user behavior, identify areas of improvement, and make data-driven decisions to drive growth and optimize your product's performance.

Provide Ongoing Support and Enhancements: Establish channels for customer support and engagement to ensure ongoing satisfaction and gather feedback post-launch. Regularly release updates, new features, and enhancements based on user needs, industry trends, and feedback. Continuously strive to improve your product to meet the evolving demands of your customers.

Finally, Stay Updated and Adapt: Stay informed about the latest industry trends, technological advancements, and regulatory changes in the fintech landscape. Continuously adapt your product and business strategy to remain competitive and seize opportunities. Embrace a culture of learning, innovation, and agility to navigate the dynamic fintech ecosystem successfully. And remember, the fintech space is tough, always evolving and changing as new technologies arise, so be prepared to face challenges along the way.

Our take on this

And as for us, we at Develative are more than prepared to help you and your team along the exciting journey of your fintech startup. Remember we talked about creating a team of nearshore engineers and finding the right product development partner?

Let's talk about that now.

Finding a Product Development Partner:

Collaborating with a product development partner can be instrumental in building a successful fintech product. A reliable partner brings technical expertise, industry knowledge, and an experienced development team. A product development partner can help you accelerate the development process, reduce time-to-market, and provide guidance on best practices.

Here at Develative, we're a US-based staff augmentation and product development company with an extensive team of engineers in Argentina and Latin America with deep understanding of fintech and lending domains, we can provide end-to-end development solutions tailored to your specific needs.

We bring to the table more than 10 years of experience of working with fintech and financial products and a bunch of technical partnerships so you can rest assured you are following best practices (AWS Partners, Okta/Auth0 Partners, Azure/Microsoft Partners, etc)

With our expertise in scalable architecture, regulatory compliance, and cutting-edge technologies can help you overcome challenges and create a robust fintech product.

By considering the main points discussed in this guide and partnering with a reputable product development company like us, you can navigate challenges and create innovative fintech solutions that cater to the evolving needs of customers in the digital age.

Lastly, remember, success in fintech comes from blending technology, user-centric design, and a deep understanding of the industry.

#Fintech #ProductDevelopment #FintechStartups

About the author

Lucas Ocon

Lucas is the Chief Executive Officer of Develative. He's in charge of the strategic direction and handling the growth at the company; also he serves as the performance coach of the on-site team, making sure the team has a career path tailored to each team member's expectations and goals. He enjoys spending time with his dogs and music venues.